Buy USDT Quickly and Securely

A trusted cryptocurrency for global and daily transactions.

What is USDT?

USDT (Tether) is a stablecoin, a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, in this case, the US dollar. Unlike volatile cryptocurrencies like Bitcoin, USDT's value remains close to $1, making it a compelling choice for traders and investors who want to minimize risk in the volatile crypto market. It is widely used on exchanges to move funds quickly and save or transfer money across borders. You can buy USDT on various platforms to enjoy its stability and liquidity.

USDT is available on blockchain networks, including USDT TRC20 and USDT ERC20. USDT TRC20 is issued on the TRON network, recognized for its minimal fees and rapid transaction speeds, establishing it as a popular choice for users looking to move funds efficiently. On the other hand, USDT ERC20 operates on the Ethereum network, offering a higher level of security and widespread compatibility with various decentralized applications (dApps). Both options provide flexibility for users looking to buy, hold, or transfer USDT.

How to Buy USDT

The exact steps may vary depending on the platform chosen, and the overall experience may differ. Be sure to follow the instructions provided by your service or platform to ensure a smooth transaction.

Why to buy USDT (Tether)

USDT transactions are processed almost instantly, granting you instant access to your funds. Whether you're trading or sending money, USDT ensures your transactions are completed without delays, making it a fast and efficient choice for users who need quick access to cryptocurrency.

Unlike traditional bank transfers, which can be slow and cumbersome, purchasing USDT offers unparalleled convenience. You can buy USDT 24/7, from anywhere in the world, without worrying about banking hours or delays. Multiple payment methods, such as credit cards and alternative payment options, are supported, making buying USDT easy and accessible.

As a stablecoin, USDT aims to preserve a value similar to that of the US dollar, making it a great option for users looking to steer clear of the fluctuations seen in other cryptocurrencies while still reaping the advantages of blockchain technology.

With USDT available across various blockchain networks like TRC20 and ERC20, it offers global access to fast, low-cost transactions, making it ideal for international users who need to send or receive funds across borders quickly and cheaply.

What Can Be Purchased with USDT

USDT, a widely recognized stablecoin pegged to the US dollar, provides a flexible option for various transactions within the cryptocurrency ecosystem. Users can purchase a diverse array of goods and services, starting with digital assets like cryptocurrencies, altcoins, and tokens on various exchanges. Many platforms allow the trading of USDT for popular cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), making it convenient for investors.

In the gaming and entertainment sectors, USDT can be used to acquire in-game items, virtual goods, and gaming tokens. Numerous gaming platforms accept USDT as a payment method, enabling seamless purchases of upgrades and collectibles. Additionally, many NFT marketplaces accept USDT, allowing users to buy unique digital art and exclusive items.

The retail sector is also embracing cryptocurrency, with certain online and physical stores accepting USDT for everyday transactions. This includes a wide range of products, from electronics and clothing to travel services. As more merchants integrate USDT into their payment options, users can spend their holdings directly without converting them back to fiat currency.

Furthermore, USDT is commonly used in decentralized finance (DeFi) applications, allowing users to lend, borrow, or stake their USDT for potential returns. This functionality enhances the utility of USDT beyond mere transactions, making it a versatile tool for users looking to navigate the evolving landscape of cryptocurrency and finance.

Supported Payment Methods

A variety of credit and debit cards are accepted, including major providers like Visa and MasterCard. This enables a seamless purchasing experience, allowing users to buy USDT quickly and securely using their preferred card.

Some platforms may support purchases via PayPal for added convenience, providing a fast and secure payment option.

This digital wallet allows for convenient transactions, enabling users to make purchases with ease.

Similar to Apple Pay, Google Pay offers a quick and secure method for buying USDT.

This option allows users to fund their USDT purchases through bank transfers, providing a reliable and familiar method of payment.

Whether users prefer instant payments or more traditional methods, a range of options is typically provided.

FAQs

Trusted Platforms for Buying USDT

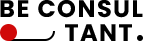

Buycoin.online provides a range of payment methods to suit different user preferences. Alongside this flexibility, the platform offers instant transactions for quick access to funds, competitive low fees that help maximize value, and dedicated customer support for an enhanced user experience. Whether you’re a beginner or an experienced trader, Buycoin.online aims to deliver seamless and efficient service to meet your trading needs. Stay tuned for Buycoin news.

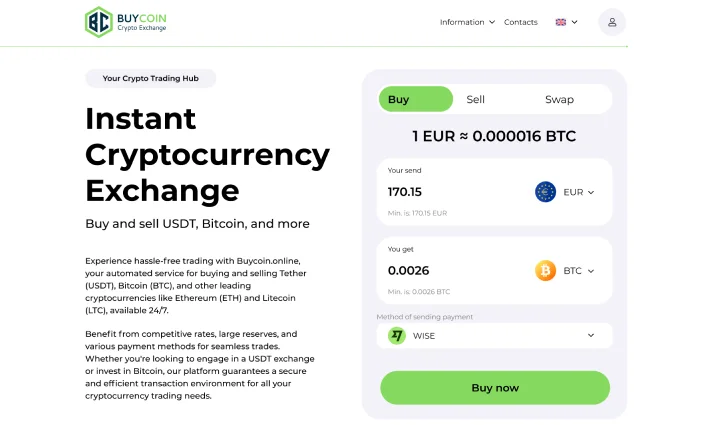

Binance ranks among the world's largest cryptocurrency exchanges, offering a safe and effective platform for purchasing USDT. Featuring an extensive selection of trading pairs and robust security measures, Binance is favored by both novice and seasoned traders alike.

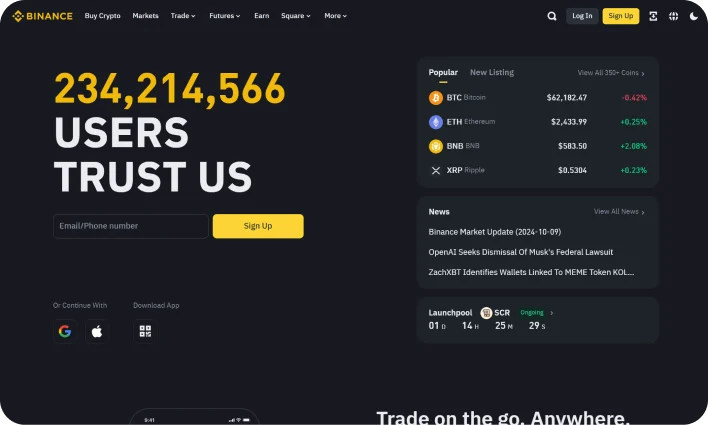

Huobi is a well-established cryptocurrency exchange that offers a safe and user-friendly environment for purchasing USDT. With competitive fees and various payment options, Huobi serves users seeking a dependable platform for purchasing and trading digital assets.